Doomer or Boomer

“You are all going to die” - Warren Buffett.

I like to trade and starting a Substack right here right now is a fun asymmetric trade. Either I am self-immolating myself by doom-posting the pico schmico bottom, or I am right and claim infinite clout later. If things trend back up, I will just delete this (champions adjust) and pretend it was never written.

To introduce myself: my full real name is chumbawamba22. Some of you may already pay me my standard $1M/follow on my locked X account (renewals are coming due soon). Due to recent changes in Bitcoin price I am lowering it to $500K. Please DM me if you are interested.

For what it is worth, I feel much more comfortable in single name equities and sometimes worthless cryptocurrency ponzis - that is where I have built my “skillset”. So naturally I will not talk about any of that here but instead ramble about the preponderance of macro risks stacking up that worry me.

I’ve been doomposting on twitter dot com, as one is apt to do, for the past few weeks. This post will explore why.

I may write more in the future. I may not. If you subscribe the chance of me writing more goes up 1%. If 100 of you subscribe that is 100%.

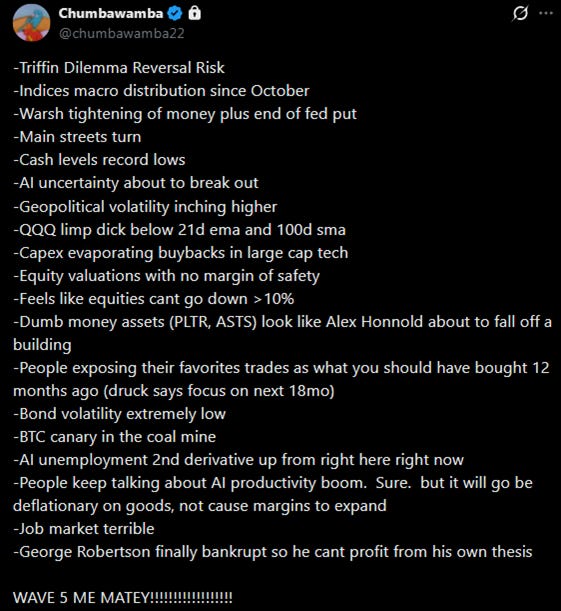

Doompost

You can just say things

People love saying things. They don’t have to be true or have any merit in 2026. Some dude received 170,000 views on twitter for quoting Charlie Munger as saying that you should buy stocks at the 200d moving average, which he obviously never said. And I think that’s just beautiful.

One thing people love to say is that it is impossible to predict the top of bubbles/major trends and therefore you should stay long the entire time to capture the meat of the move. Okay sure, but I would prefer to not lose all my money.

I suppose that is one way, but it requires a skillful exit, as many crypto market participants are recently learning is harder than it sounds. Throughout the past few years in cryptoland, everybody said selling the top is easy: “just sell the right shoulder”. And then David Bailey plowed a trillion dollars in at the forever top and about zero people called it (95%+ of people were looking for $140-180k).

And so, all this to say - I think it is appropriate to take shots at downside when the odds of downside actualizing are elevated. ~vibes~ suggest we are in one of those in one of those moments for equities. You the reader probably disagree, but this is my attempt at chasing clout, not yours.

Equities have been in an epic secular 16 year bull run carried by a few major tailwinds that may be at risk:

The “greatest businesses ever created” - capital light technology companies with network effect moats. Cash cows that have gotten the market drunk on expectations around the continual plowing of free cash flow into stock buybacks

Employment flows - passive flows into 401ks, which predominately purchase large cap equity indices, have gone from single digit market share in the 2000s to ~50-60% of the market in 2026. In other words, waves of price agnostic buying each month, with each new dollar inflow allocated proportionally to each stonks weight in the index. Stock big now, stock bigger later. This is a large part of why we are seeing large cap market concentration

Expansion of liquidity post 2008, most notably measured by the increase in the federal reserves balance sheet by 700% since the GFC. Warsh represents a posture shift towards tightening money (maybe bearish fed balance, definitely bearish fed put) at a time when increasing amounts of liquidity are going to be sucked up by main main stress and AI capex spend

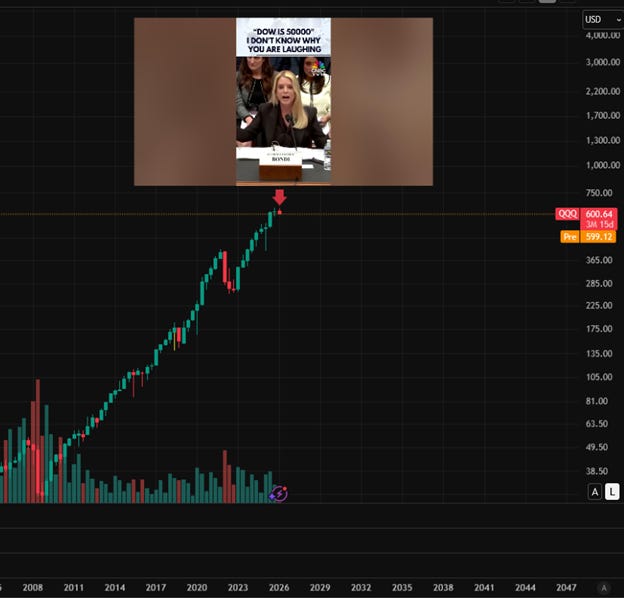

Stonks Only Go Up

Someone once said, “Chart Looks Good”. The Nasdaq looks like it has been in distribution since October 2025. Are you going to dump on the boomers or are the boomers going to dump on you?

It has been well socialized, but hyperscaler buybacks are trending to zero as these businesses *must* reinvest their free cashflow into growth capex to maintain competitiveness. Idk man it seems to me that there is always cheap open source/chinese model 6-12 months behind what these companies are spending $700bn annually to create. Someone smart will tell me why isn’t true but I would just respond with the word “distillation”.

Anyway, seems like these guys better not slow down their spending! It would actually appear that they must continue to reinvest for the foreseeable future to maintain their competitive edge. It’s also pretty clear that these guys believe it is existential to their existing businesses to spend this money. I am not Warren Buffett, but capital intensive businesses which need to reinvest all of their free cash flow to defend their competitive positioning don’t seem like “the greatest businesses in the entire world”. Free cash flow down only, buybacks halted. George Robertson mode.

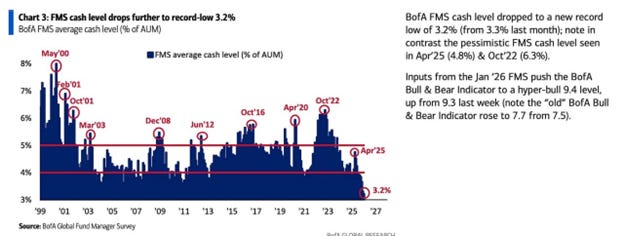

Of course, this too comes at a time where everyone is max confident in equities, as they only go up, buy every dip. Retail participation in stocks all time highs. Cash levels all time lows.

Same as it ever was.

It is better to be artificially intelligent than stupid

Uh oh! There is a meta now where if you think AI is bearish then you are a dumb doomer and if you dismiss AI then you are an old boomer. Even as I write this, having an opinion on AI is becoming a crowded trade. My view is that the exact specifics don’t matter as much because it is increasingly probable that uncertainty goes up only over the next few years - and uncertainty is almost always bearish risk assets. Equity risk premium goes up and multiples go down.

We obviously can’t know how the next few years play out. Is Dario Amodei (Anthropic CEO) talking his book or does he have information asymmetry and is actually best positioned to provide an opinion? IMO people saying he’s talking his book at this point is pure cope - we’re going to see a lot of denial over the next few years, just seemingly what humans do when presented with negative information. If you are to believe Dario, which I directionally do, he is telling you that we are in an exponential growth curve in AI capabilities (recursive self-improvement). If only a fraction of his claims come true, uncertainty is about to go up only.

One of the dumber reasons why AI is so polarizing is because different people are using different AI. Boomers are using free models from 2023 and sharp tech bros are running 8 openclaw agent swarms 16 hours a day. I think it’s pretty obvious to anyone who has spent time with Claude Code or Openclaw that we have crossed some sort of chasm where Dario’s views have become seemingly more credible.

What I do know is that the financial incentive to automate human labor is staggering. The cost of a junior/mid level white collar worker making $100k salary is roughly $150k if you include benefits (401k match, medical, dental, insurance, real estate allocation, etc). Which means the present value of that employee is ~$2.5mm. Even if you only include the first 10 years of the discounting period, eliminating the employee immediately accretes $1.2mm in equity value to a firm. These incentives become even more apparent if we enter a recession, which could be catalyzed caused by a larger sell-off in equities given how much stock market wealth has driven consumer spend.

So right here, right now we have a situation where stock buybacks are halting because they are being redirected into capex spending that is directly designed to eliminate white collar workers who have been purchasing index funds indiscriminately for the past decade+. Sounds not great?

The left curve thesis is that unemployment bad. Economy bad. Stocks bad. Uncertainty bad. Employment flows are halted or reversed, indices get destroyed. Bad.

The right curve thesis is that AI is going to create deflation driven by labor displacement and margin compression. If productivity gains are widely distributed across companies, which seems like a reasonable expectation for operating expense reduction, competitive dynamics force companies to pass savings through to consumers rather than retain them as profits. The price of goods will go down. Deflation.

We are seeing a microcosm of this play out in software, where the inherent uncertainty is causing everything to indiscriminately sell-off. If the unemployment narrative catches wind, I think we see this play out on a larger scale.

Even in the most hyper optimistic scenario where the hyperscalers build AI GOD 5000 who produces INFINITE PROPSERITY IMMEDIATELY, it seems likely that unemployment goes up only which has to impact consumer spending. We are in populist times and the populace will tax the AI god to feed themselves and pay their existing mortgages.

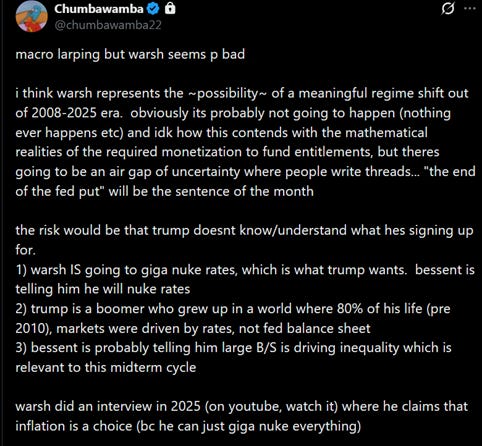

Macro Larp

The Warsh trade in isolation has played out a bit which was most easily expressed by shorting crypto. I posted the following the night before Warsh was formally announced (he had moved to ~95% odds on poly). Honestly at the time it was one of those things where nobody was paying attention to Warsh.

The geniuses of crypto currency twitter dot com, including the greatest investor of all time Michael Saylor, started bull posting Warsh because he said the word “bitcoin” in an interview. What he actually (basically) said was that if BTC is going up the Fed is doing a bad job. Incredible scenes.

So that was a pretty easy trade and I think has meaningfully played out at this point. But I still believe that people are underestimating that Warsh may represent a regime shift. Everyone talked about how timing the top of 2021 required recognizing a regime shift (tightening cycle), so I am hypersensitive to identifying potential regime shifts going forward.

It’s cool these days to say that Warsh is an empty suit that won’t do anything. I sense some denial here but fair enough, it probably is chalk if you go off of history and how these guys end up behaving.

But spiritually, Warsh represents an incremental removal of the fed put. While he may not be able to achieve his ambitions on reducing the balance sheet (time will tell), he does seem firm and consistent that he will unleash the liquidity floodgates only to the extent that an extreme crisis requires it. Bessent and Warsh separately published op-eds in the WSJ (sept and nov 2025) effectively saying the same thing. Like 3 months ago the dude re-iterated his views. I think you have to assign some probability he follows through.

Pro main street policies, less federal reserve distortion in markets, a higher threshold for providing liquidity. This is all philosophically aligned with many of Druckenmillers ideology on the Fed that he has espoused over the last decade (i.e., the growth of QE/Fed Balance sheet has impacted equity valuations). These guys are all aligned and I think deserve to be taken more seriously. Druck has been extremely public about how the US essentially needs austerity to fix the debt situation. Midterms increase the probability of posturing towards benefiting Main Street, not Wall Street.

Meanwhile, Trump is looking to reorient major long-term geopolitical forces. We can quibble about why he is doing this (I think the Grant Williams x Michael Every podcast is incredibly thought provoking) - but in the simplest terms: Trump is seemingly trying to turn America away from a country that consumes and financializes everything into one that builds and produces things again — specifically so it can maintain military superiority over China. Seems to me geopolitical volatility is up only and a net impact of these policies and moment in time is the reversal of globalism, which was yet another tailwind for dollar denominated equities.

Why I am wrong

If the thesis is wrong it’s probably mostly wrong for a couple reasons:

Timing - the entire thesis could be right but true AI impacts (e.g., unemployment fear) could be 3 years away, not now. The reason why today feels like heightened risk is that claude code was itself a chatgpt moment, buybacks have reached an inflection point, and liquidity drain from capex spend seems to be impacting the most risky of assets

Bessent and Warsh successfully transition fed balance sheet to commercial balance sheet without negatively impacting liquidity conditions, get rates significantly lower, and reduce financing costs and ultimately refinance the debt at low rates

Stonks only go up, employment flows not really impacted yet, and ROIC on the hyperscalers is infinite. In the long term, things get tricky if you fully play out the AI thesis to its extreme. Interest rates are probably very low in this environment given the deflationary forces referenced above, which is positive for equity multiples all else equal. But it is very difficult to think a decade ahead with all of these changes that are imminent, which is kind of my point on uncertainty going up.

Where it may not matter

The new inevitabilities of life are death, taxes and AI compute. Companies w/ indiscriminate demand because they are in the capex/compute supply chain seem unaffected by many of the factors listed above. It probably feels late, but the AI lab compute spend seems to be growing well into the triple digits per year if you take Dario at face value. Semis are less than 1% of global GDP today. The differentiated memory market is effectively an oligopoly still trading at cyclical multiples. This is an example where time is likely better spent versus large cap tech.

As an expression of the above, I am overweight cash compared to 6 months ago. I continue to own Micron and SK Hynix after owning memory since late 2024. And some small amount of QQQ put options through April that I will close if the trend goes back up (21weekly ema for example).

Agnostic of this thesis, I continue to own a long term portfolio of businesses that I think are secular category winners run by strong management teams that are positioned to steal market share in the event of a market downturn.

Regime Shift?

And you may ask yourself

“How do I work this?”

And you may ask yourself

“Where is that large automobile?”

And you may tell yourself

“This is not my beautiful house!”

And you may tell yourself

“This is not my beautiful wife!”

Subscribe

As a reminder please hit the subscribe button. If you need to free up space, unsubscribe from The Giver.

Disclaimer

This post is provided for comedic and informational purposes and should not be construed as professional financial advice or investment recommendations.

Which companies do you own that will perform in a market nuke

mythical reel pull